An estimated 80 million Americans have by now received the highly anticipated government stimulus check through direct deposit. If you haven’t received it yet, go read this article immediately and figure out why.

I Didn’t Get My Stimulus Check Yet

Now, you’re probably thinking about what you should do with this money. Learning how best to budget this money is imperative to your benefit. Those who have been laid off or furloughed are highly encouraged to use the majority of this money for necessities, but any portion of it that you can put towards saving counts. For those who are still gainfully employed, there are a number of opportunities to make the most of this cash.

Spending Categories to Budget Your Stimulus Check

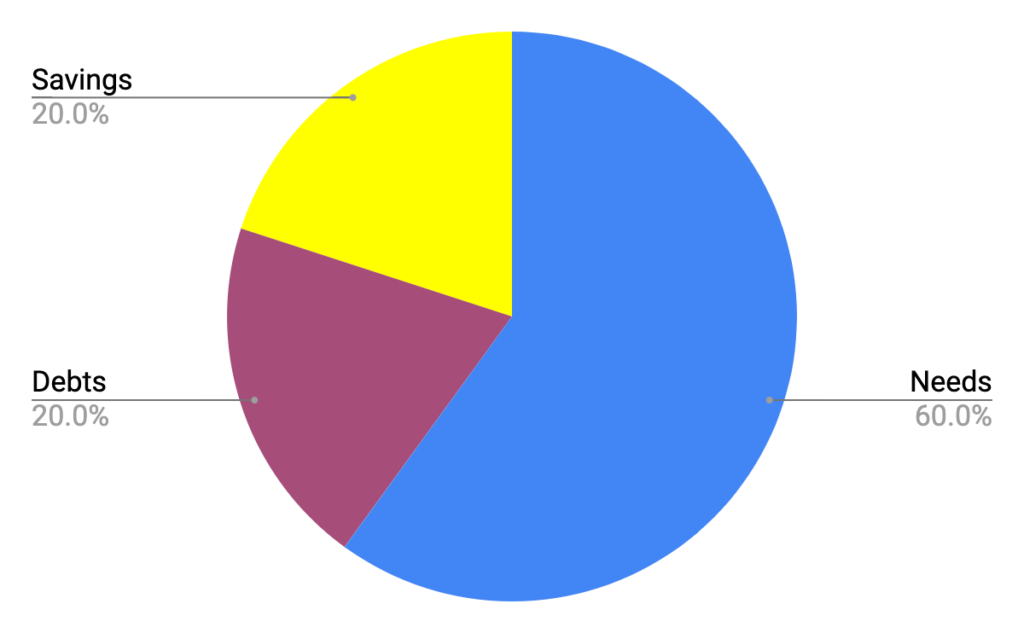

Regardless if you are single or married, it is estimated that you should be spending on average about 60% of your check on needs. Traditionally, basic needs are considered to be food, water, shelter, and clothing, but these necessities vary from person to person. Whether it be food, shelter, or emergency medical expenses, taking care of your basic needs is crucial during this time.

If you have had a decrease in income or change in circumstances that will make it difficult to pay your rent on time, the U.S. Department of Housing has set up guidelines to address tenant concerns during the Coronavirus National Emergency.

Many utility companies are offering customers forgiveness on their payments by providing extended payment plans. Be sure to check with your providers to see if they are participating in these types of relief programs. Make sure that all of your demands are met in case of any unexpected suspensions in the future.

As working people, we have to take care of ourselves financially, as well as mentally and physically. As quarantine has taken a toll on all of us, we should strengthen our efforts to try and reserve some of this money towards the well-being and necessities for ourselves and our families. We have compiled a list of ideas and free resources that you and your family can access

Free Resources To Access During Coronavirus

We can all agree that food is the most important of all the basic necessities. You can budget better and save money on food by taking advantage of coupons and discounts offered by various online and local grocery stores. We have combined a list of coupons and offers to help you look for alternative ways to make ends meet.

Paying Down Debt

About 20% of your stimulus check should be set aside for paying down any outstanding debts. Whether these be student loans, auto loans, mortgage payments, credit cards, or any other financial obligation, it is important to make sure that you try your best to maintain these payments. Paying down your debt is always a good option if you have extra cash to spare. While we encourage you to pay your credit cards down, we also encourage you to keep these accounts open. You never know when you may need that credit line in the future. Keeping your account open can provide you with the option to use it if needed. It also helps keep your credit in good standing with these accounts, while having little to no balance in them.

The same goes for Brigit users– it is much better to have a safety net in place, even if you don’t need money immediately. Any resources you have that provide you the advantage of getting money when you need it most should be top on your list.

Emergency Savings Funds

Planning for the future can be challenging, but it is one of the most important factors when budgeting. Investing in or contributing to an existing savings account is extremely important. This cannot be emphasized enough. Having savings is often regarded as a luxury, but every little bit counts, even if it’s just a small portion. You really never know when you’ll need it. Unexpected auto, appliance, or home maintenance repairs could crop up at any time. This is an area that we encourage you to administer around 20% of your stimulus check.

If able, you should consider investing in a high-yield savings account. Online banks are usually the best option when searching for a good fit. The interest rates on these types of accounts are often significantly higher than those offered from brick and mortar banks. Not only is the signup process smoother, they typically do not require a minimum balance or surprise you with any hidden fees. If you are interested in opening a high-yield savings account, The Balance recently released their list of Best High-Yield Savings Accounts for April 2020 and it is a great place to start if you are considering options.

If you don’t want to deposit your money in an online savings account, you can use the old school piggy bank to save your money and only use the money if unexpected expenses crop up. Remember that your next stimulus check will hit your bank account only after a month, so use your check wisely.