Get cash for

- Get cash fast1

- No late fees or tipping

- No credit check

4.7+ rating with 562k reviews on the App Store and Google Play

Get cash – with no credit check or late fees

No late fees. Free extensions on repayment. With Brigit, we won’t ding you if you need more time to pay it back.

Avoid overdrafts and worry less

Brigit warns you when it looks like your account won’t cover your expenses, so you can request an advance and worry less about overdrafts.

Get cash fast

With Express Delivery, you can get your cash in minutes, for a small fee2. If you’re not in a rush, you’ll get it in 2-3 business days and it’s always free.

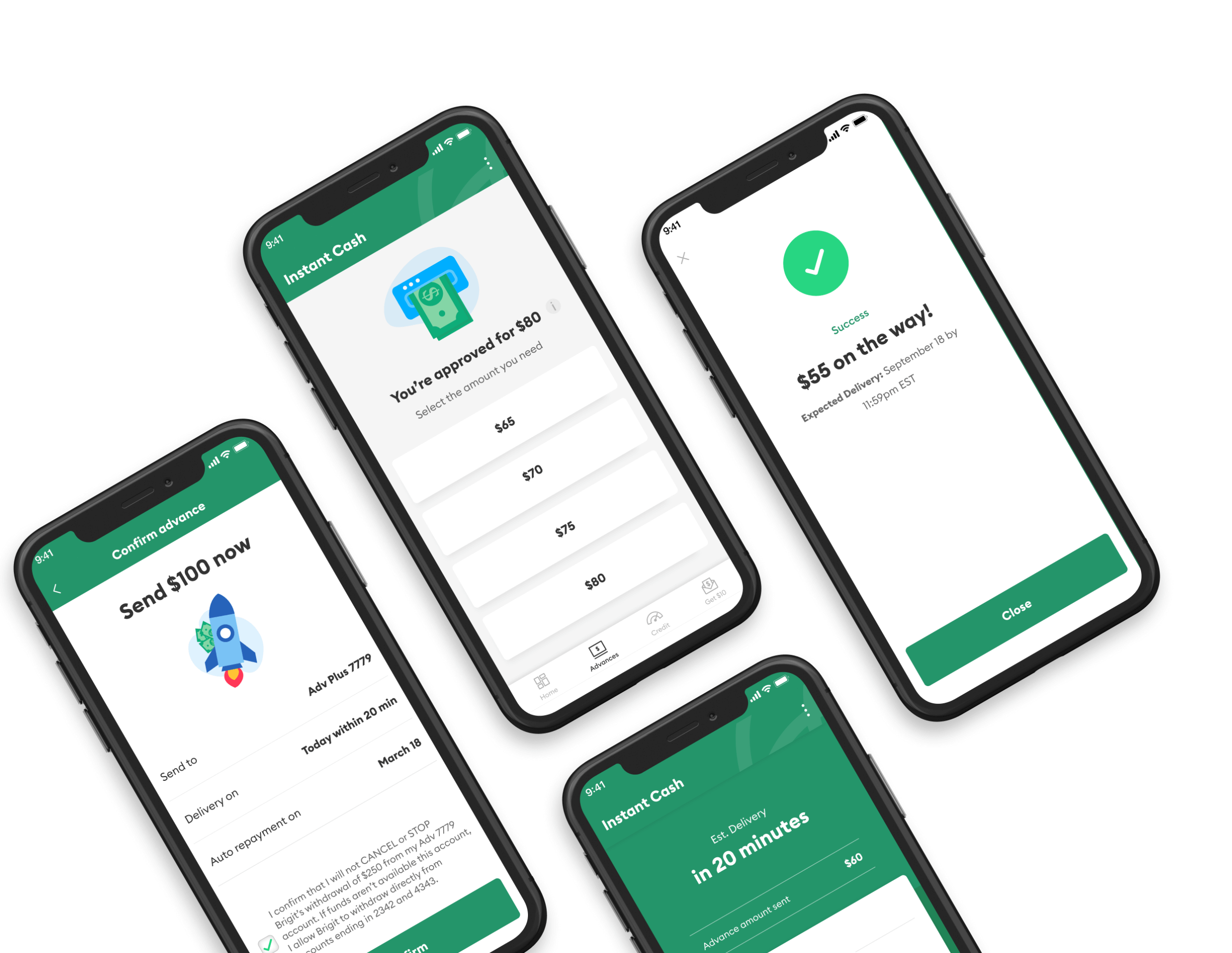

How to access Instant Cash

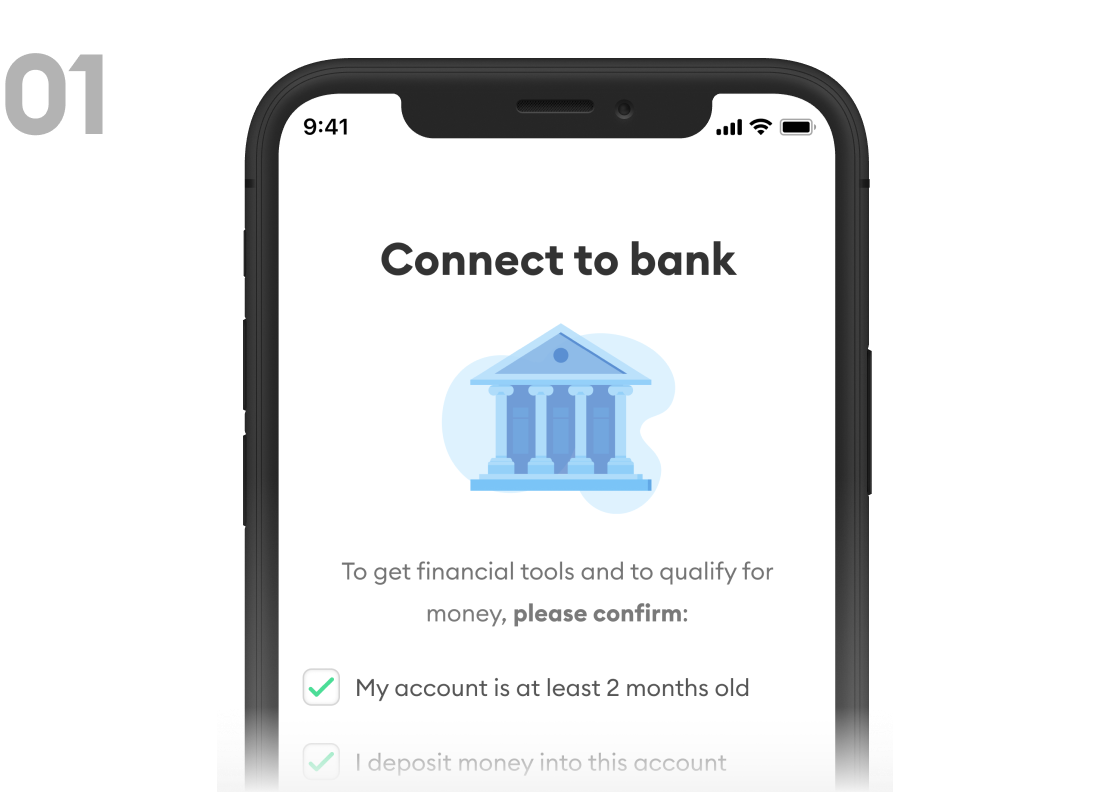

Sign up for Brigit

Download the Brigit app, connect your checking account, and select a plan (paid monthly subscription may apply1). Make sure you connect your primary account that you use daily and check that it’s:

- Active for at least 60 days

- Has a balance above $0

- Has 3 recurring deposits from the same source

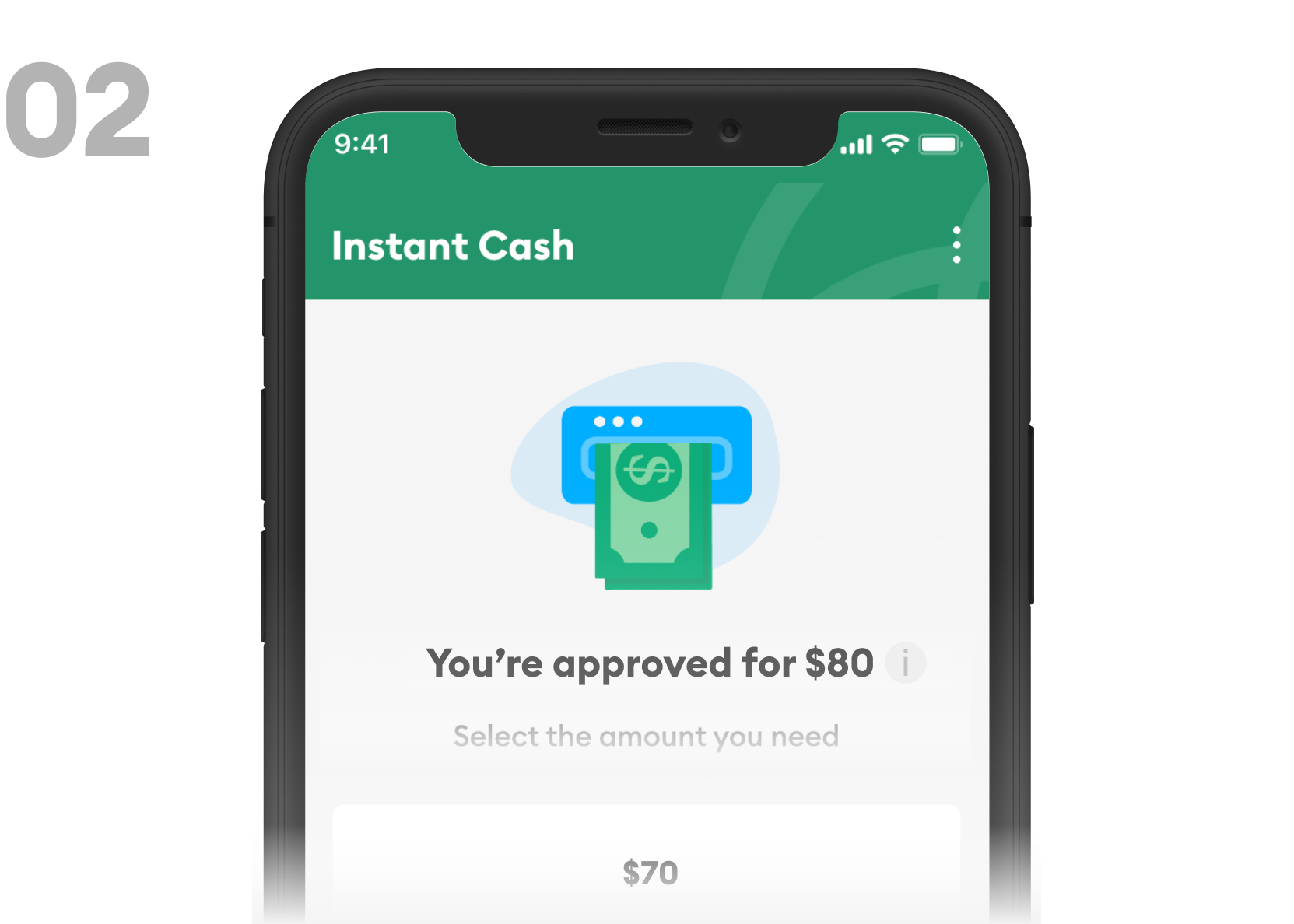

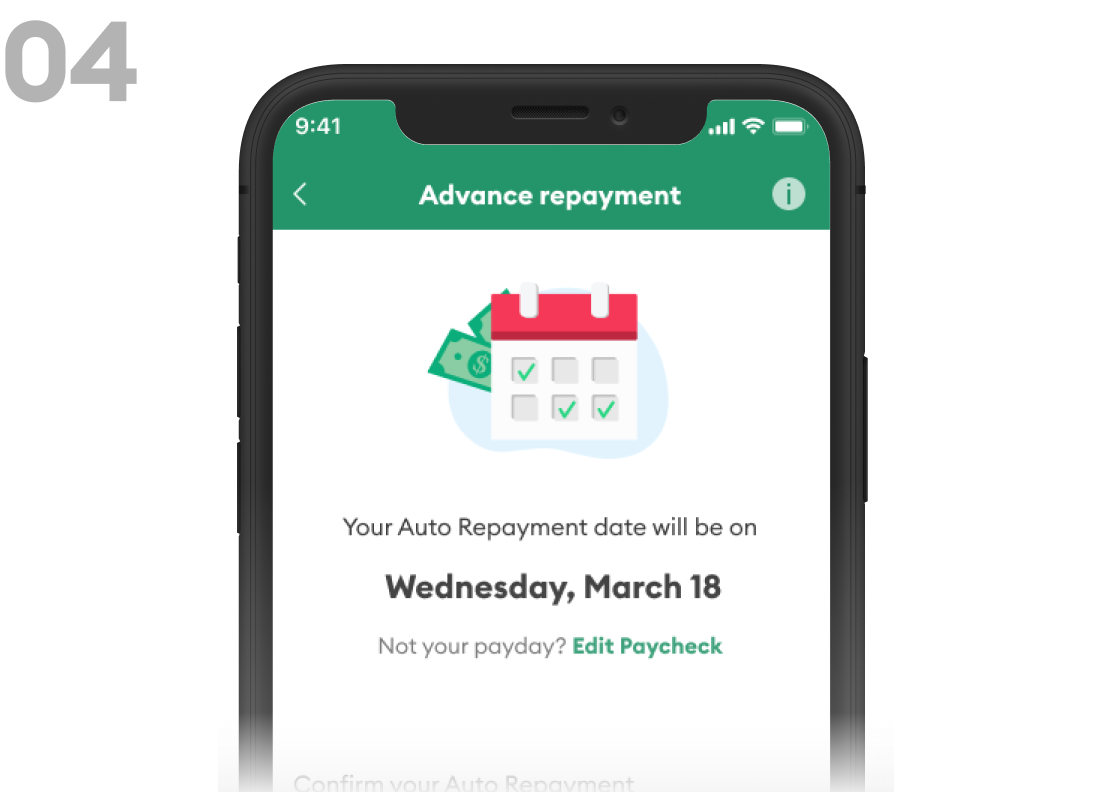

Request an advance & set a repayment date

Once you’ve been approved for Instant Cash1, you can request an advance up to your approved amount directly in the app. You’ll also choose your repayment date, which is typically set as your next payday.

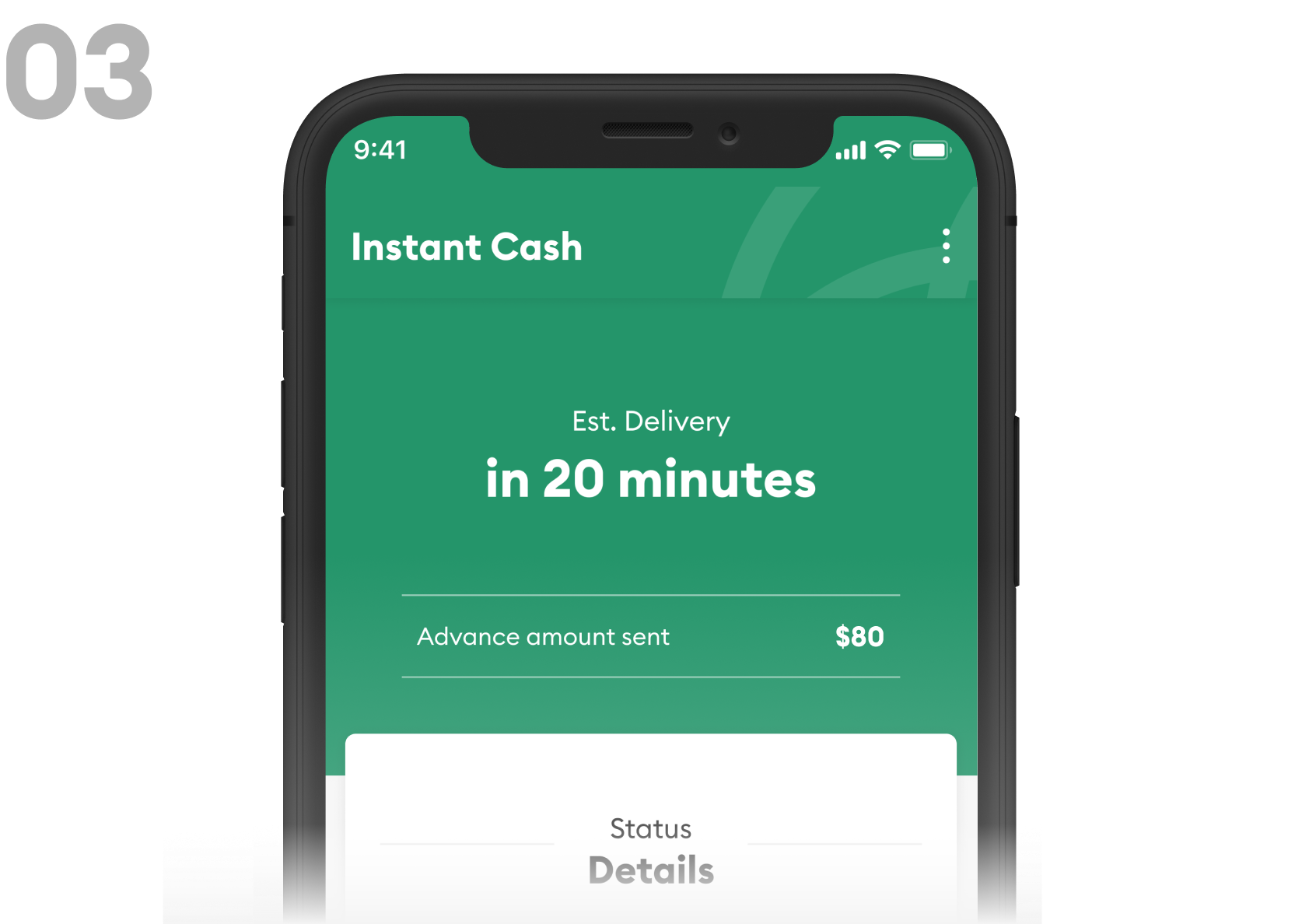

Get your cash

Your cash will be deposited into your bank account, so you can cover that unexpected bill or have cash on hand when you need it. To access it immediately, you will pay a small Express Delivery fee2. Otherwise, it will be delivered in 2-3 business days for no fee. No interest or tips, ever.

Repay your advance and request another

Need an extension on your repayment? No problem—and no fee. You can choose a new date that works for you in the app. Once you’ve repaid your advance, you can take out another.

What our members are saying

Amy, WA

"If you’re in a bind and need emergency cash, this is the app to use. I literally had no money for groceries and this app truly helped me out. Was able to buy food and fill up my tank. Thankfully I'm okay till my next paycheck. Thank you Brigit!"

Melissa, MS

"Brigit is the only app of its kind that has worked so easily, so perfectly, EVERY SINGLE TIME. Doesn't cost you an arm & a leg, and gives you time to catch up, without all the hoops to jump through that others seem to require. This app has saved me repeatedly, and helped bring up my credit score while doing it!"

Jason, WV

"I was able to keep my head above water because of how Brigit helped me. I have horrible credit because of helping people in the past. Brigit did not care about that, they helped me no questions asked."

Access Instant Cash and more with Brigit

Get cash fast

Approval for an advance is a few taps away. No late fees. No credit check.

Build your credit4

For as little as $1/month, we’ll help you build positive payment history.

Manage your budget

Understand your spending and earning trends to get a better grasp on your finances.

Protect your identity3

Keep your identity safe from fraud with full credit reports and up to $1 million in identity theft protection.

Have questions?

To qualify for Brigit Instant Cash, your checking account must meet the following criteria:

Checking account with sufficient activity:

- Adding your primary checking account and using it daily helps us accurately predict your spending and earning patterns.

- Using your account every day for a couple of weeks should satisfy the requirement.

Checking account has at least 60 days of activity:

- If you just opened your account, wait until your account is 60 days old.

- If your account has been open for over 60 days, please wait one business day, and if the requirement is still not met, reach out to us.

Balance is greater than $0:

- We’ve found that members with less than $0 in their bank account have trouble using our service to maximize their financial health.

- If your balance is above $0, please hold tight until we receive updates from your bank to meet this requirement.

You have a cash cushion in your account at the end of day you receive your paycheck:

- We require a minimum average end-of-day balance on days you receive your paycheck to make sure that you can repay Brigit on time.

Deposit or Income Requirements:

- To qualify for Brigit Instant Cash you must have at least three recurring deposits from the same employer or deposit source.

Please note:

- ATM deposits, paper checks, cash transfers, or paychecks with irregular pay schedules do not qualify at this time.

Brigit looks at your account information and calculates a Brigit score from 0-100. The score is used to determine whether you qualify for Brigit Instant Cash.

Brigit calculates this score by looking at your account data across three categories: Bank Account Health, Spending Behavior, and Earnings Profile.

What score do I need to qualify for Brigit Instant Cash?

The Brigit app will tell you the minimum score you will need to qualify. Scores can range from 40 to 100.

How is my score calculated?

Brigit calculates this score by looking at your account data across three categories: Bank Account Health, Spending Behavior, and Earnings Profile.

Bank Account Health:

This score factor primarily reflects:

- Balance status and fees: Your average balance over time and the number of bank fees you’ve been charged.

- Account activity: How long your bank account has been active and how often you use your account.

Earnings Profile:

This score factor is made up of two main contributing general attributes:

- Monthly recurring deposits: Deposit amount from the same employer or another deposit source.

- Deposit history: Deposit size and number of recurring deposits in your account.

Spending Behavior:

This score factor primarily reflects:

- Budgeting habits: How much you spend vs earn each month.

- Bill payment history: How often you make routine bill payments.

- If an advance is requested before 10:00 am EST on a business day, they will arrive the same day by 11:59 pm (local time).

- If an advance is after 10:00 am EST, they will arrive on the following business day by 11:59 pm (local time).

- If an advance is requested at any time on a weekend (Saturday or Sunday), they will arrive on the following business day by 11:59 pm (local time)

Brigit works with over 6,000 banks and credit unions.

Our search form allows for easy location of your bank. If your bank does not appear in our search form, we do not currently support that bank at this time.

- Go to Settings

- Tap Connected Bank Account

- Add a debit card & enter your card details

You will need to confirm your date of birth to help keep your account secure. Brigit will then deposit $.01 into your account to confirm your debit card is linked to your checking account.

Once your debit card has been verified, you will be able to choose Express Delivery when requesting advances.