Build credit for a

- Save just $1/ month to build payment history

- No credit approval

- No interest or upfront deposit

4.7+ rating with 562k reviews on the App Store and Google Play

Designed for everyone

Whether you have no or bad credit, you can start building your credit in seconds with instant approval. No credit needed and no hard credit pull.

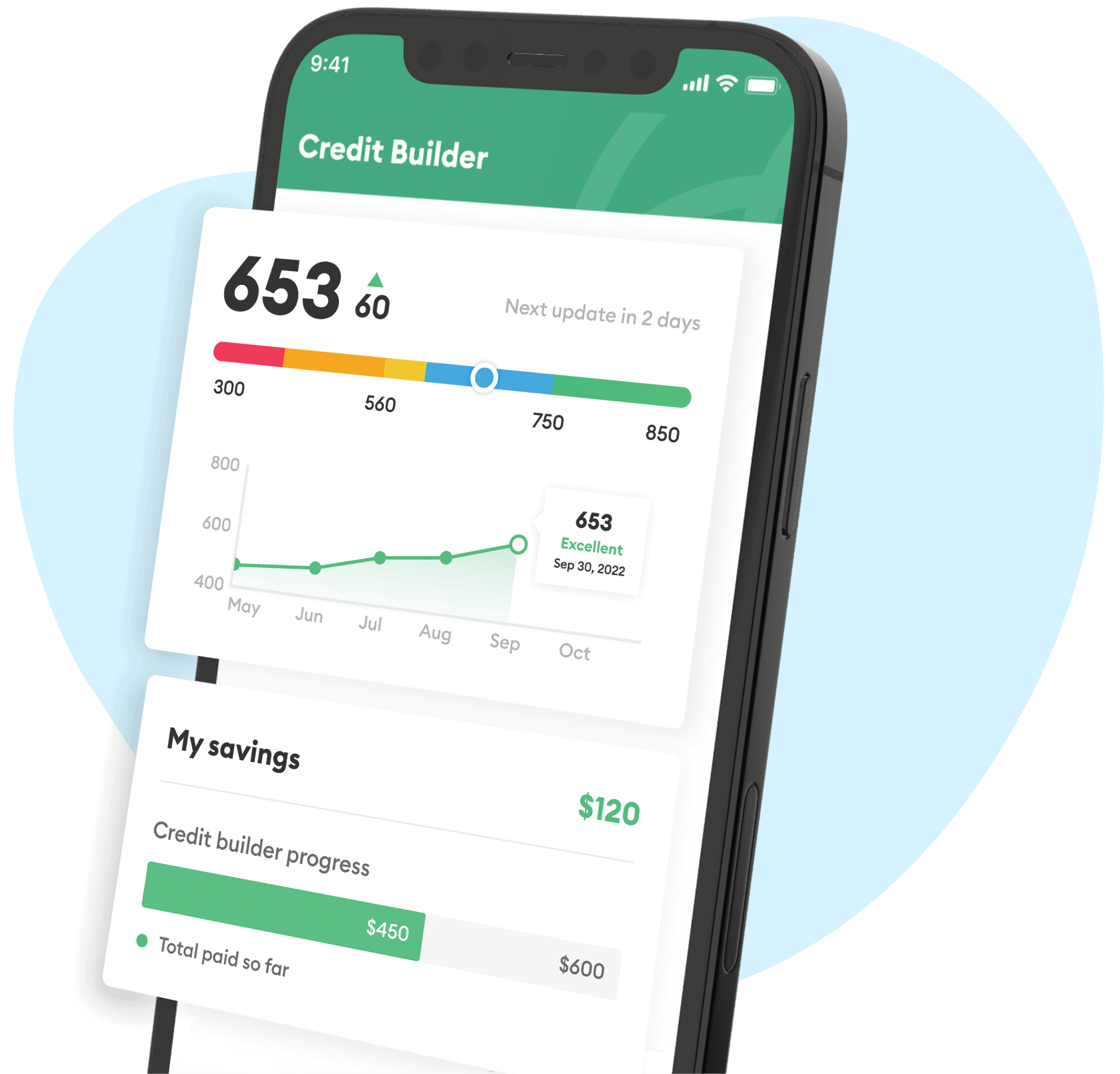

Build credit while building savings

Made to build your credit fast

Build positive payment history – the single most important factor for your score.

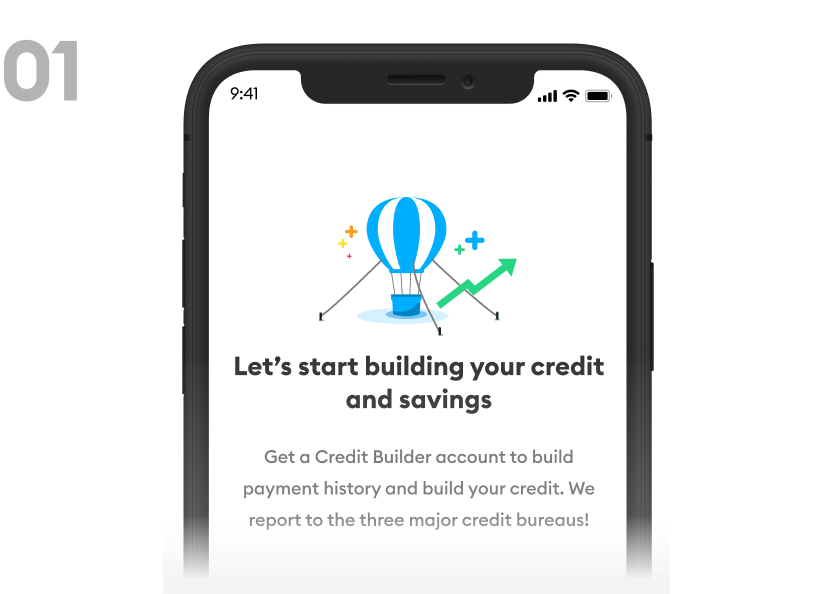

Get started in seconds

Open a Credit Builder account

No hard pull or credit score required. Set up your account in minutes to start building credit history and improving your credit mix.

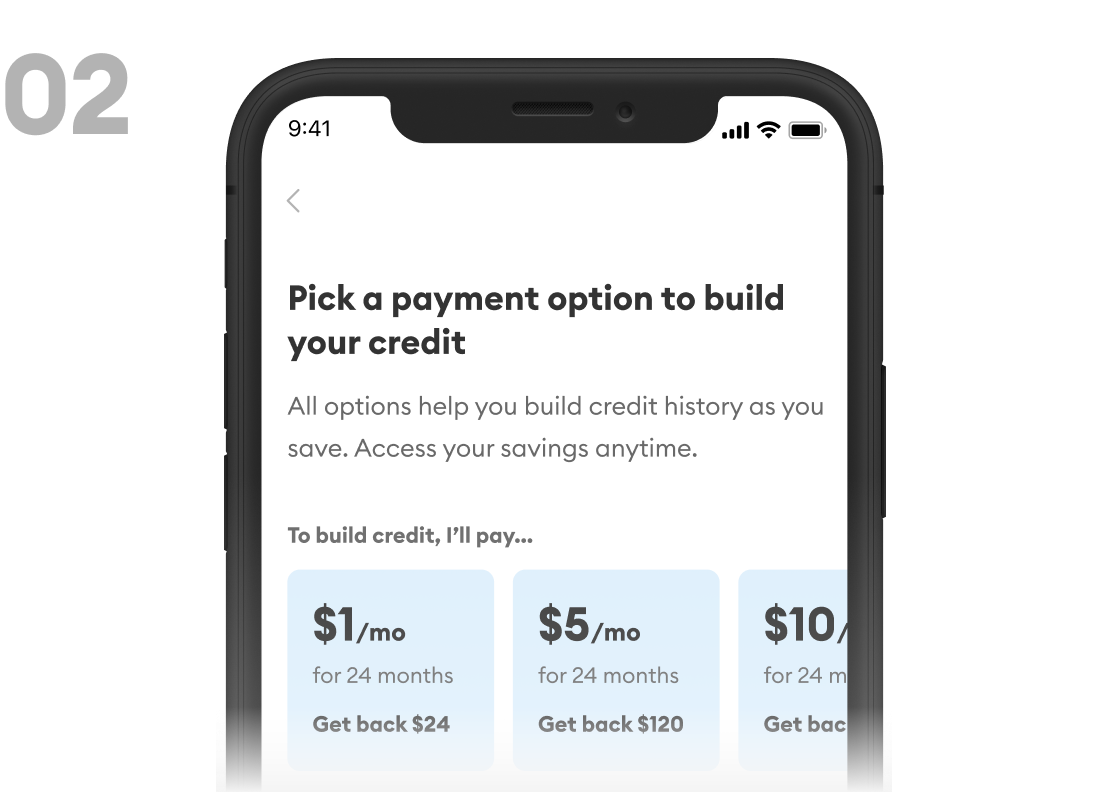

Start with as little as $1 per month

Choose how much to save each month. These payments are reported to the three major credit bureaus to create payment history.

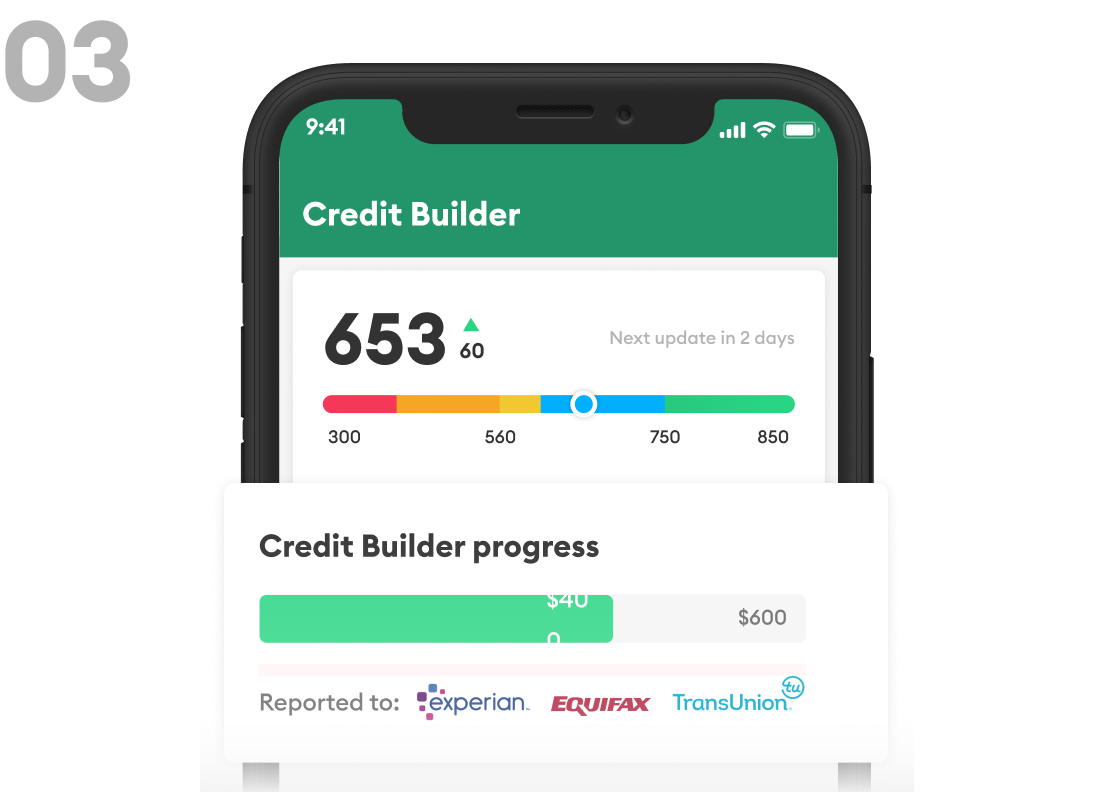

Build payment history

Each payment is reported to the three major credit bureaus—Experian, Equifax, and TransUnion. On-time payments build positive payment history and your credit.

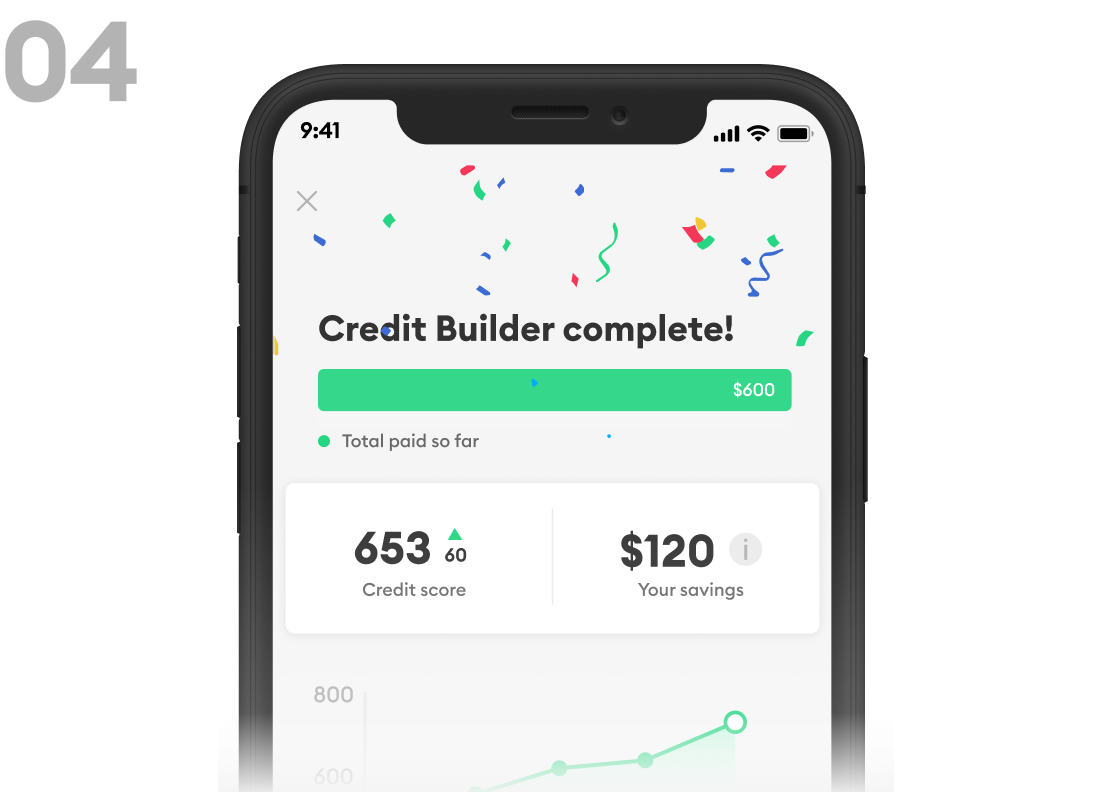

Better credit, more savings

Better credit, more rainy day funds. At the end of your credit journey, you’ll have built credit by showing on-time payment history and added to your savings.

What our members are saying

Mishea, AL

"I saw my credit score jump by 79 points with Credit Builder—in just the first month! I’d recommend Brigit to any of my friends as an easy way to build credit."

Rion, OH

"I was approved instantly! Brigit has helped me establish on-time payment history that will stay on my credit report for the rest of my life. It's an easy, safe, and secure way to build your credit."

Andrea, CA

"Credit Builder is helping me heal my credit so I can buy my dream house one day. With Brigit, it’s like I have a team of experts right at my fingertips, helping me live a better financial life."

What you can do with Brigit

Build your credit

For as little as $1/month, we’ll help you build positive payment history.

Get cash fast3

Approval for an advance is a few taps away. No late fees. No credit check.

Manage your budget

Understand your spending and earning trends.

Protect your identity2

Keep your identity safe from fraud with up to $1 million in identity theft protection.

Have questions?

The Credit Builder account is designed to help you to build credit by setting aside savings each month.

In short: Each month you save your selected amount, we report payment activity on credit builder installment loans we open on your behalf. This builds payment history, which makes up 35% of your credit score.

How it works: First, Brigit arranges a credit builder installment loan for you and deposits it into a FDIC insured deposit account with Coastal Community Bank, Member FDIC.

You do not have access to the money from your Credit Builder installment loan. Brigit reserves the funds for you in the secured deposit account.

Brigit reports the Credit Builder installment loan to the three major credit bureaus (Experian, Equifax and TransUnion).

You decide how much you want to save. Each month you save, Brigit reports to the credit bureaus as if you’re making payments on the reported loan.

Plus, every time you save that amount is available for you to access.

At the end of your term, the loan is reported as paid in full and any remaining savings you’ve accumulated throughout the term are accessible to you.

Brigit does NOT perform a hard credit pull.

We collect some personal information (like name, address, date of birth and SSN) in order to verify your identity, but we do NOT perform a hard credit pull or inquiry, and there is no minimum credit score required to open the account.

When you first open your Credit Builder account, you might see a small dip in your score. This is normal; it happens whenever new credit accounts are added to your report.

As you start making monthly payments, we report them to the three major credit bureaus which help you show positive payment history and build your credit.

Brigit’s Credit Builder account is designed to help you build your credit by showing the credit bureaus positive payment history, the most crucial factor for your score. It also helps you grow your savings, as each payment that you make towards your minimum monthly payment is added to your newly established deposit account at Coastal Community Bank. You can withdraw your savings at any time.

Yes! Your Credit Builder payments and current Credit Builder loan balance are reported to all three bureaus, TransUnion, Experian, and Equifax, every month.

How it works: First, Brigit arranges a credit builder installment loan for you and deposits it into a FDIC insured deposit account with Coastal Community Bank, Member FDIC.

You do not have access to the money from your credit builder installment loan. Brigit reserves the funds for you in the secured deposit account. Brigit reports the credit builder installment loan to the three major credit bureaus (Experian, Equifax and TransUnion).

You decide how much you want to save. Each month you save, Brigit reports to the credit bureaus as if you’re making payments on the reported loan. Plus, every time you save that amount is available for you to access.

At the end of your term, the loan is reported as paid in full and any remaining savings you’ve accumulated throughout the term is accessible to you.

Yes. Sometimes financial circumstances change, so we do allow you to cancel your Credit Builder Loan Account at any time.

Should you choose to do so, we will report the Credit Builder installment loan as “paid in full”.

The Credit Builder loan is there to help you report payment activity to the credit bureaus, NOT to give you access to the funds.

Here’s how it works:

When you open your Credit Builder account, the credit builder installment loan is reported to the credit bureaus. As long as you save each month, Brigit reports to the credit bureaus payment activity on the loan. This helps you establish payment history, which is a major factor in calculating your credit score.

No. Unlike traditional personal loans or Brigit Instant Cash, you do not have access to the money from your Brigit Credit Builder loan.

When your Credit Builder account is opened, the loan proceeds are held in a new, secure deposit account that we open in your name. You can withdraw your savings at any time directly in the Brigit app.

Why? Your Brigit secure deposit account is designed to facilitate on-time payments and establish a positive payment history, the most important factor for your credit score.

If you need access to money immediately, consider using Brigit Instant Cash instead.

You can access your Credit Builder savings at any point by heading to the Credit Builder section in the Brigit app and tapping on “Withdraw Funds.” From there, select the amount you’d like to withdraw, either a partial amount or the entire amount that you have saved up to this point. Keep in mind that the savings will be transferred to the checking account you have linked to your Brigit account