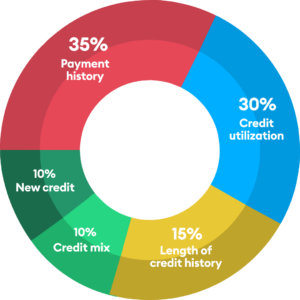

Your credit score is a financial measurement that impacts your ability to do a lot of things. It’s important to understand the factors that play a significant role in shaping your credit score. Here are the elements that have the most impact on your credit score.

1. Payment history (35%)

To maintain a positive payment history, ensure that all your bills, including credit cards, loans, and other obligations, are paid on time. Even a single late payment can linger on your credit report for up to seven years. So it’s critical to always pay by the deadline.

The single most influential factor affecting your credit score is your payment history. This accounts for a 35% of your FICO credit score. Lenders want to see a track record of on-time payments. Any missed or late payments can have a detrimental effect on your credit score.

2. Credit utilization (30%)

Credit utilization refers to the ratio of your credit card balances to your credit limits. This ratio makes up 30% of your credit score, playing a big role in determining your creditworthiness. High credit card debt can signal financial strain and negatively impact your credit score.

To optimize your credit utilization, keep your credit card balances below 30% of your credit limit. Regularly review your credit card statements, and if possible, pay off balances each month. This responsible credit management can positively influence your credit score over time.

3. Length of credit history (15%)

The length of your credit history contributes 15% to your credit score. This includes how long your accounts have been established, the age of your oldest account, and average age of all your accounts. A longer credit history can be viewed positively by lenders as it provides a comprehensive view of your financial behavior.

You can’t control the age of your oldest account, but you can manage the average age of your accounts. Avoid opening multiple new credit accounts in a short period; that can lower the average age of your credit history and potentially impact your credit score.

4. Types of credit in use (10%)

The variety of credit accounts you have in use contributes 10% to your credit score. Lenders appreciate diversity in credit types, such as credit cards, installment loans, and mortgages. Managing different types of credit responsibly shows you can handle various financial obligations.

While it’s not a good idea to open new credit accounts solely for the sake of diversity, maintaining a mix of credit types as part of your overall financial strategy can positively impact your credit score.

5. New credit (10%)

New credit accounts, including credit inquiries and recently opened credit lines, makes up 10% of your credit score. It’s essential to occasionally open new credit accounts for financial growth, but frequent credit inquiries can reflect negatively.

When shopping for loans or credit, try to do so within a short timeframe to minimize the impact of multiple inquiries. Be strategic about opening new credit accounts, focusing on those aligned with your financial goals and ensuring that you can manage them responsibly.

Additional considerations

1. Public records and collections

While not part of the FICO scoring model, public records like bankruptcies, tax liens, and collections can negatively impact your creditworthiness. These items may remain on your credit report for several years and should be avoided whenever possible.

2. Credit score inquiries

Regularly checking your own credit report or having your credit score checked by potential lenders generally does not have a significant impact on your credit score. These are known as “soft inquiries.” However, multiple “hard inquiries” resulting from loan applications within a short period can lower your score temporarily.

Key takeaways

Understanding the factors that influence your credit score the most helps you make informed financial decisions. Prioritize on-time payments, managing credit card balances responsibly, maintaining a longer credit history, diversifying your credit types, and being cautious about new credit. You can actively work toward improving and maintaining a healthy credit score.